Not everyone who looks at gold is thinking about charts or fast profits. Many people are simply curious. They notice prices moving and quietly wonder if now is the right time. For most beginners, gold trading in the UAE isn’t about strategy—it’s about trust. Can I buy safely? Can I sell later without stress?

That’s where platforms like Delor feel reassuring. The process stays calm, clear, and unhurried. Whether someone chooses gold bars or Jewellery, the decision doesn’t feel forced.

Is Gold Trading Legal in the UAE?

This is usually the first question people ask—and for good reason. Anyone searching for how to trade gold in the UAE wants clarity before making a move.

The short answer is yes. Gold trading is legal in the UAE. But it’s also regulated.

This structure is actually what makes the market feel safe. The rules exist to prevent fake products, unclear pricing, and unreliable sellers. Licensed traders must meet specific standards, and serious buyers naturally avoid anyone operating outside that system.

This is why many people prefer well-known platforms where documentation, pricing, and product details are transparent from the start—especially when dealing with physical gold like bars or Jewellery. The law isn’t designed to intimidate buyers. It exists so that once you buy, you don’t have to worry afterward.

Regulatory Authorities for Gold Trading in the UAE

Most buyers never interact directly with regulators, but their presence shapes the market quietly in the background.

Gold trading in the UAE is overseen by multiple authorities, each with a specific role:

- Some focus on licensing

- Others monitor trade standards

- Some oversee market behavior and compliance

The result is subtle but important: fewer counterfeit products, clearer documentation, and smoother transactions. Because sellers know the system is watching, trust becomes the norm rather than the exception. This structure is one reason the UAE gold market feels calmer and more reliable compared to many other regions.

While learning the basic steps is important, achieving safe gold trading in UAE requires a clear understanding of the legal framework, market structure, and best practices explained in the main guide.

Best Licensed Gold Trading Companies in the UAE

Once legality is clear, the next question becomes simple: who should you buy from?

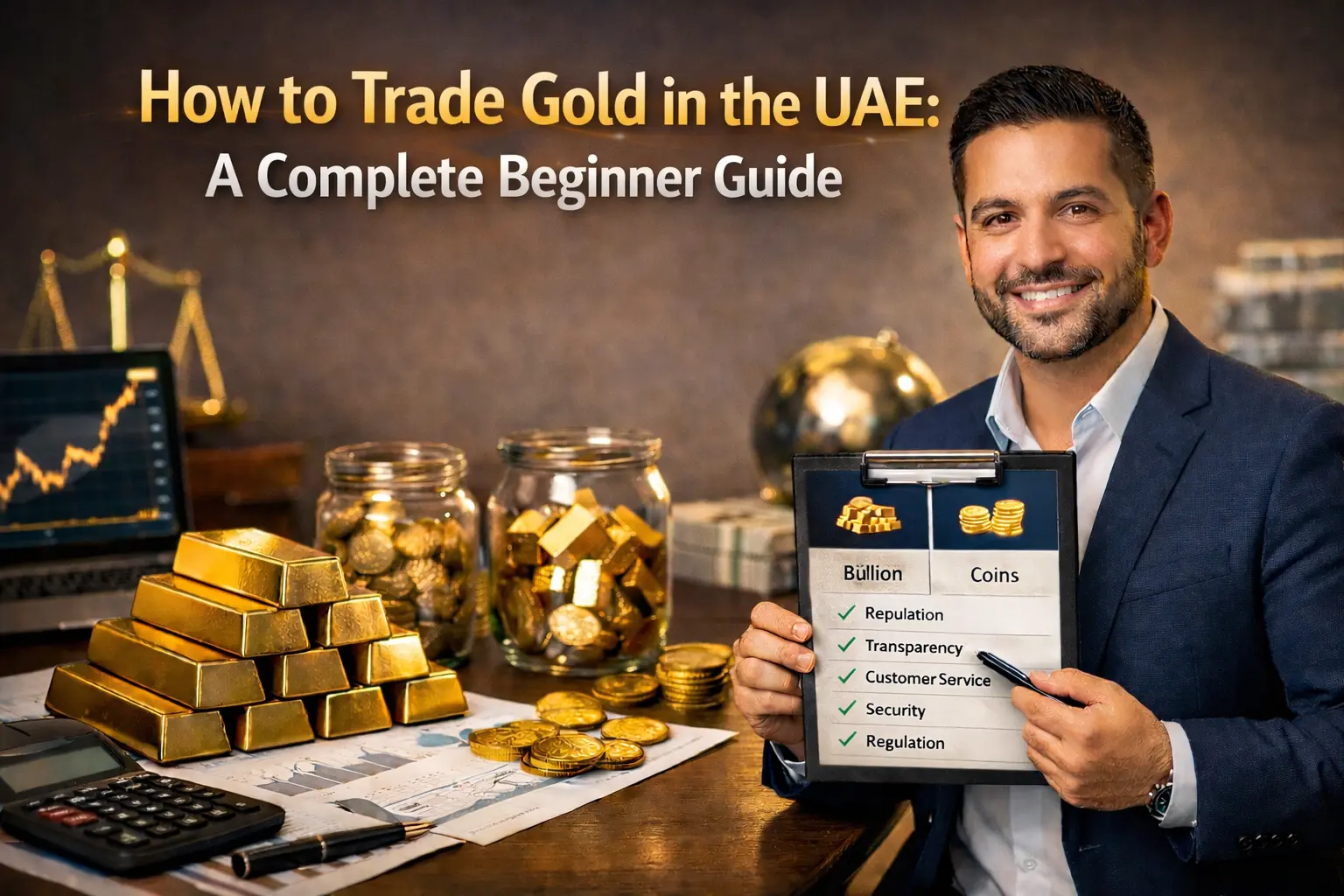

Anyone seriously exploring gold trading for beginners in the UAE quickly realizes that the choice of seller matters more than perfect timing.

Licensed companies differ in style:

- Some are traditional and store-based

- Others focus on online platforms with clear listings and pricing

What most buyers value is clarity—prices that make sense, information that doesn’t change mid-process, and documentation that feels complete. This is why many investors feel comfortable with platforms like Delor. Browsing, comparing, and deciding happens at your own pace, without pressure.

In practice, the “best” gold trading company is usually the one you don’t think about twice after the deal is done.

How to Start Gold Trading in the UAE (Step-by-Step)

Most people don’t start with a grand plan. They start with curiosity, then research, then hesitation. That’s normal.

Here’s how beginners usually start gold trading in the UAE:

- Define your goal: Are you buying for long-term value, savings, or stability?

- Choose the form of gold: Physical gold feels safer for many beginners, while others prefer simpler options.

- Select a licensed seller: Look for clarity, not pressure.

- Start small: One purchase is often enough to understand pricing and process.

- Keep proper records: Receipts, purity details, and dates matter more than most people expect.

Timing becomes important later. At the beginning, understanding how prices move is far more valuable than trying to buy at the perfect moment.

Taxes and Fees on Gold Trading in the UAE

This section often surprises people—in a good way.

The UAE does not impose personal income tax on gold trading, which is a major reason the market attracts investors. That said, you must be aware of the following charges:

- VAT Exemption for Investment Gold: Transactions involving pure investment gold (bars, coins) with a purity of 99.9% or higher are generally exempt from VAT (Value Added Tax).

- VAT on Jewelry: VAT (currently 5%) is typically applied to manufactured gold jewelry, ornaments, or products below the high purity investment threshold. Always confirm the VAT status with the seller upfront.

- Operational Fees: You may encounter Making Charges (for ornaments), service fees, or small seller margins. These should always be clearly itemized on your receipt.

Knowing the full cost before buying removes stress and keeps decisions grounded.

Best Times and Hours for Gold Trading in the UAE

Gold prices in the UAE follow the global Spot Price, meaning movement is dictated by international market overlaps. Here are the key activity windows relative to UAE Time (GMT+4):

| Time Slot (GMT+4) | Global Markets | Activity Level | Description |

| 7:00 AM – 11:00 AM | Asia/Early Europe | Quiet Start | Prices move, but usually lack strong momentum. Good for calm observation. |

| 11:00 AM – 4:00 PM | European Overlap | Moderate/High | Activity increases significantly as the European markets (like London) open. Prices start to find direction. |

| 4:00 PM – 1:00 AM | US Power Hours | Highest Volatility | The most dynamic period. Prices can shift quickly due to major US economic news releases. |

For physical gold buyers, exact timing is often less important than the daily price. Over time, people stop chasing perfect timing and choose moments that simply feel calm and manageable for their investment goal.

Gold Trading in Dubai vs Abu Dhabi vs Sharjah

| Feature | Dubai | Abu Dhabi | Sharjah |

| Market Presence | Highly visible, many shops & platforms | Fewer sellers, more structured | Smaller, more personal |

| Buyer Preference | Variety and price comparison | Long-term holding | Simplicity |

| Trading Style | Active and fast-paced | Slower, deliberate | Relaxed |

| Regulations | Unified across UAE | Unified across UAE | Unified across UAE |

| Best For | Variety seekers | Stability-focused buyers | First-time buyers |

Tips for Safe and Profitable Gold Trading in the UAE

Most mistakes happen when people rush. Anyone learning how to trade gold in the UAE safely should focus on protection before profit.

- Buy from sellers you understand

- Keep all documentation

- Avoid emotional decisions

- Watch price movement before acting

- Know how and where you’ll sell later

The safest gold trades are usually quiet ones—no pressure, no regret afterward.

Conclusion

Gold is everywhere in the UAE, yet learning how to deal with it takes time. Most people begin with curiosity, then caution, then small decisions.

When someone asks how to trade gold in the UAE, they’re usually not chasing fast profit—they’re trying to avoid mistakes. That’s where choosing the right partner matters. Delor is known for a calm and transparent approach, where decisions aren’t rushed and details are clearly explained. You understand what you’re buying, and you move forward with confidence at your own pace.

Confidence grows slowly, and that’s exactly how gold trading should begin.

FAQs

How do beginners start gold trading in the UAE?

Most start by learning the basics and buying a small amount from a trusted seller to understand pricing and process.

Do I need a license to trade gold in Dubai?

Only businesses need a gold trading license. Individuals buying for personal investment usually do not.

Can beginners trade gold safely?

Yes, especially when starting slowly and dealing with licensed sellers.

Is physical gold better than digital gold?

It depends on comfort level. Physical gold offers clarity and peace of mind, while digital options offer convenience.

Why is gold trading popular in the UAE?

Because the market is regulated, transparent, and trusted globally.