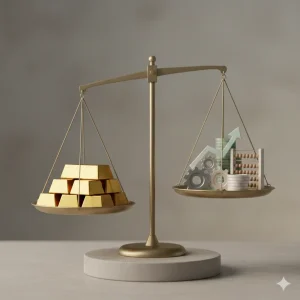

Investment choices often reflect how much risk a person is willing to accept. Some prefer assets that feel secure and familiar, especially during uncertain economic periods. Gold Investment fits this mindset, offering a sense of balance between value preservation and financial discipline. When approached with proper knowledge, gold can serve as a supportive element within a wider investment plan.

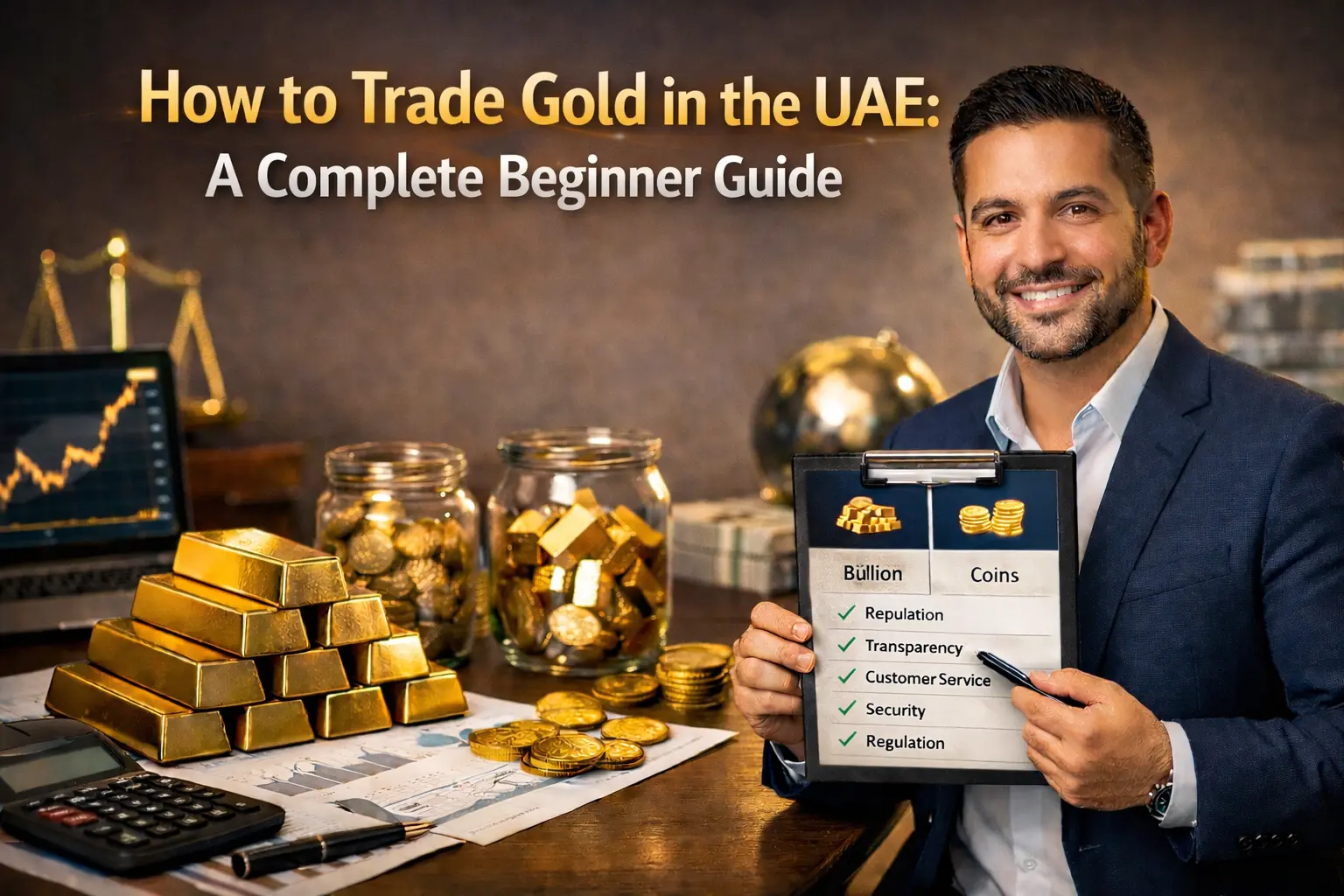

How to Choose a Trusted Gold Trading Company

Choosing a trusted gold trading company is one of the most important decisions any gold buyer can make. This guide explains how to evaluate gold trading companies step by step, identify common red flags, and verify pricing, documentation, and regulatory compliance to invest with clarity and confidence in 2026.

What Is Gold Investment and Why It Matters

When people talk about money, they usually talk about safety before profit. Gold fits naturally into that conversation. Gold Investment means choosing an asset that people already understand and trust. It is not built on complex ideas. Gold is valuable because it has always been valuable.

What really makes gold important is how it behaves when things feel unstable. Prices go up and down, currencies change, markets react fast. Gold does not follow the same rhythm. That difference is why many investors keep it in mind when they think about balance, not growth alone.

For someone starting out, gold feels less intimidating than many other options. You can see it, price it, and track it easily. delor help explain how to invest in gold without pressure, which matters for people who want calm decisions, not rushed ones.

Why People Choose Investment in Gold

- Gold Investment appeals to people who prefer assets they can understand without complex explanations or technical barriers. Gold feels familiar, which gives investors a sense of comfort when making long-term decisions.

- Many choose gold because it helps protect savings during inflation. When money loses purchasing power, gold often keeps its value better than cash held for long periods.

- Investors who want balance often see gold as a stabilizing element. It behaves differently from stocks, which helps reduce overall portfolio pressure during market drops.

- For beginners, learning how to invest in gold feels more approachable than entering fast-moving financial markets. Gold prices are visible, widely tracked, and easier to follow.

- Those exploring how to invest in gold for beginners often appreciate that gold does not rely on company performance, management decisions, or quarterly earnings.

- Gold attracts people who want to avoid emotional trading. It supports slower, more thoughtful planning rather than daily buying and selling.

- Some investors choose gold because it offers multiple entry options, making how to make investment in gold flexible for different budgets and financial goals.

- Platforms like delor support this mindset by providing clear paths toward the best investment in gold, focusing on understanding rather than pressure or hype.

How to Invest in Gold for Beginners

- Most beginners are not chasing profit. They simply want to avoid losing value. That is usually why Gold Investment feels like a reasonable first step.

- Before buying anything, take time to watch prices. You do not need charts or tools. Just notice how gold moves over weeks, not hours.

- When people ask how to invest in gold, the answer depends on comfort. Some prefer owning something physical. Others want flexibility and fewer responsibilities.

- Starting small is important. Anyone learning how to make investment in gold should leave room to learn without pressure or regret.

- Many beginners overthink the process. In reality, how to invest in gold for beginners is about simple decisions, not perfect timing.

- Gold works better with patience. It is not designed for daily trading or quick reactions to news.

- Understanding resale options matters more than entry points. Knowing how easily you can exit builds confidence.

- Services like delor focus on guidance rather than urgency, helping people slowly move toward what feels like the best investment in gold for their own situation.

Best Investment in Gold for 2025 (Options Compared)

| Option | Key Features | Best For |

| Physical Gold | • Tangible asset • Easy to understand • Full ownership • No digital involvement | Conservative investors who value clarity and possession |

| Digital Gold | • No physical storage required • Easy transactions • Transparent pricing • Lower entry barrier | Investors who want convenience without handling physical gold |

| Gold-linked Products | • No direct ownership • Exposure to gold price • More liquidity • Suited for trading strategies | Flexible investors looking for price exposure without storage |

| General Considerations | • Liquidity matters more than purchase speed • Fees important in the long term. • Comfort and habits matter | Depends on individual risk tolerance, involvement level, and budget |

| Platform Example | • Delor platform offers clear comparisons • No pressure environment • Fits diverse investment styles | Investors who seek guidance and clarity before making a choice should consider the risks of investing in gold. |

Risks to Consider Before Investing in Gold

- Before getting into Gold Investment, it helps to admit one thing early: gold is not magic. Prices rise and fall, sometimes slowly, sometimes unexpectedly.

- A common mistake is assuming gold always goes up. It does not. There are periods where prices stay flat for years, and that can frustrate people who expect quick results.

- Buying at the wrong moment can affect confidence. Many people enter when prices are high because everyone is talking about gold.

- Physical gold feels safe, but it brings real responsibilities. Storage, security, and access all matter more than most beginners expect.

- Selling gold is usually possible, but not always instant. In some cases, it takes time, paperwork, or acceptance of a lower price.

- Currency differences can quietly affect returns, especially if gold is bought or sold in a different currency.

- Emotions play a role. Watching prices daily can lead to unnecessary stress and rushed decisions.

- Fees often are ignored. Small costs, when repeated, slowly reduce value over time.

- Relying solely on gold can limit flexibility. No single asset should carry all expectations.

- Clear understanding reduces risk more than market timing. Service focus on explanation, not urgency, which helps people avoid mistakes caused by confusion rather than price movement.

How Delor Gold Supports Smart Gold Investment

- Most people do not come looking for gold because they are experts. They come because they want something that feels safer than what they already have.

- Delor Gold understands that hesitation. The process starts with listening, not selling.

- Gold Investment feels less intimidating when someone explains it without assumptions. No one is expected to already “know the market.”

- Options are not pushed. They are laid out calmly, so people can think instead of reacting.

- Some investors need time. Delor Gold does not rush that moment. Decisions are allowed to breathe.

- Questions are treated as normal, not inconvenient. Many people ask the same things, even if they think they should not.

- Risks are mentioned early. Gold is not presented as perfect or guaranteed.

- Practical details matter. Storage, resale, and access are discussed before commitment, not after.

- The focus stays on long-term comfort, not short-term excitement.

- Guidance through the Delor platform keeps the process grounded, helping people feel in control instead of pressured.

Conclusion

At the end of the day, investing is a personal decision. Some people want growth; others want peace of mind. For many, Gold Investment feels like a reasonable middle ground. It is familiar, easy to follow, and does not require constant attention. The real value comes from understanding what you are doing and why. Taking time to learn, asking simple questions, and avoiding pressure makes a big difference. This is where platforms like delor play a helpful role, offering guidance without pushing decisions, and allowing people to move forward at their own pace.

FAQs

Is gold a good investment?

Gold is usually considered a good option for people who value stability more than fast returns. It tends to hold its value over time and behaves differently from stocks or currencies .

Which investment is best for gold?

There is no single “best” choice for everyone. Some people prefer physical gold because it feels tangible, while others choose digital or gold-linked options for convenience.

How to invest 10,000 AED in UAE?

With this amount, many investors start by dividing it rather than putting it all in one place. Some choose small quantities of physical gold, while others explore structured options available locally.

What if I invested $1000 in gold 10 years ago?

If you had invested in gold ten years ago, you would likely see steady growth rather than dramatic gains. Gold’s strength is consistency. It protects value over long periods, especially during times of economic uncertainty.

What is the 20 year return on gold?

Over twenty years, gold has generally shown positive long-term performance, though returns vary depending on entry timing.

Is gold better than FD?

Gold and fixed deposits serve different purposes. Fixed deposits offer predictable returns, while gold offers flexibility and protection against inflation.