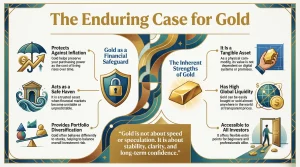

Gold has never been about trends or quick wins. People turn to it when they want something they understand and trust. Over time, gold proved it can hold value when other assets struggle. That is why many investors still look at 10 reasons to invest in gold when planning for the future. With physical options like gold bars and gold ornaments available through delor.ae, gold remains a familiar choice for both new and experienced investors.

Why Investing in Gold Still Matters in 2025

The year 2025 feels different for many investors. Prices change quickly, currencies feel less predictable, and long-term planning has become more important than chasing fast returns. This phenomenon is why many people still look at gold as a familiar option. It offers something simple in a financial world that often feels complicated and noisy.

When people search for 10 reasons to invest in gold, they are usually trying to understand why it keeps appearing in serious conversations about stability. Gold does not depend on technology cycles or company performance. Its value comes from trust built over time, especially during periods when other assets feel uncertain.

Gold also fits different types of investors in 2025. Some hold it to protect savings, others to balance risk across assets. Physical ownership, such as gold bars or gold ornaments, keeps the connection real. That tangible aspect continues to matter for people who value clarity and long-term confidence over speculation.

1. Gold Protects Your Wealth From Inflation

Inflation doesn’t happen overnight. It builds slowly, and over time it reduces what your money can actually buy. Many people only notice it when prices feel higher, but savings feel the same.

Here’s how gold helps protect wealth from inflation:

- It adjusts with rising prices: as living costs increase, gold prices often move in the same direction.

- It is not printed or controlled: gold is not affected by money supply decisions or inflation policies.

- It preserves purchasing power: over long periods, gold has helped maintain real value better than cash.

- It offers stability during price pressure: when everyday expenses rise, gold often feels like a steady anchor.

- It supports long-term saving: Gold works best for people thinking beyond short-term spending.

When people look into 10 reasons to invest in gold, inflation protection is usually one of the first motivations. Gold may not stop prices from rising, but it can help reduce how much inflation quietly erodes your wealth over time.

2. Gold Is a Safe Haven During Market Uncertainty

The movement of markets is not always linear. Sometimes they react fast, sometimes they overreact, and often they leave investors feeling unsure about what comes next. In moments like these, people usually look for something that feels steady rather than exciting.

Here’s why gold is often considered a safe haven during uncertain times:

- It holds value when markets shake: Gold tends to stay relevant even when stocks or other assets drop suddenly.

- It reacts differently than most assets: gold doesn’t always move with the market, which helps balance fear-driven periods.

- It feels familiar: during uncertainty, investors often return to assets they already trust.

- It reduces emotional decisions: Holding gold can lower the urge to panic-sell other investments.

- It supports long-term thinking: Gold encourages patience instead of constant reaction.

When people review 10 reasons to invest in gold, safety during unstable periods is usually near the top. Gold may not remove uncertainty, but it often helps investors feel more grounded when everything else feels unpredictable.

3. Gold Acts as a Hedge Against Currency Decline

Currencies change over time. Their value rises and falls based on policies, debt levels, and economic pressure. What feels stable today may not feel the same a few years later. This uncertainty is what pushes many people to look beyond paper money when planning for the long term.

When people search for reasons to invest in gold, currency protection often comes up early. Gold is not tied to any one country or financial system. Its value exists independently, which helps it hold ground when currencies weaken or lose purchasing power.

For investors, the independence matters because savings held only in cash depend entirely on currency strength. Gold offers an alternative that does not rely on government decisions or monetary adjustments. Over time, this independence has helped gold act as a buffer, especially during periods when currencies face pressure or steady decline.

4. Gold Offers Strong Portfolio Diversification

Relying on one type of asset can leave a portfolio exposed when markets change suddenly. Diversification helps reduce that pressure, and gold has long played a role in balancing investment risk across different market conditions.

Different behavior than stocks:

Gold often moves independently from stock markets. When stocks struggle, gold does not always follow the same direction.

Reduces overall risk:

Adding gold to a portfolio helps spread risk instead of relying on one type of asset.

Balances market swings:

Gold can soften the impact of sudden market drops, making overall performance feel less extreme.

Works across economic cycles:

Whether markets are growing or slowing down, gold often keeps a steady presence.

Not tied to company performance:

Unlike shares, gold does not depend on earnings reports, management decisions, or corporate debt.

Supports long-term planning:

Investors who think long term often use gold to stabilize portfolios over time.

Complements other assets:

Gold works alongside stocks, bonds, and cash rather than competing with them.

Encourages calmer decisions:

A diversified portfolio with gold reduces emotional reactions during volatility.

Trusted across generations:

Many people reviewing 10 reasons to invest in gold see diversification as a key advantage, especially when markets feel unpredictable.

5. Gold Is a Tangible Asset With No Counterparty Risk

Unlike many modern investments, gold is something you can actually own and hold. It does not depend on digital systems, promises, or future payments. This physical nature is what makes gold feel more reassuring, especially when trust in financial institutions becomes uncertain.

Here’s why gold’s tangible nature matters:

Gold is owned directly: when you buy gold, you own it outright, not a claim or obligation.

- It does not rely on banks or companies: gold exists independently and does not depend on the stability of any institution.

- There is no counterparty risk: Gold does not lose value because someone defaults, goes bankrupt, or fails to deliver.

- It remains accessible during crises: even when markets freeze or systems pause, physical gold still exists.

- Ownership is clear and simple: There is no confusion about who owns gold once it is purchased and stored properly.

When people review reasons to invest in gold, the absence of counterparty risk often stands out. Gold does not promise future returns, but it offers something many assets cannot: direct ownership without relying on anyone else’s ability to pay or perform.

6. Gold Holds Its Value Over Time (Time-Tested Store of Wealth)

Value is not only about price today. It is about what something can still represent years later. Gold has kept its place for generations because it does not lose its meaning or usefulness with time. While many assets rise and fall in relevance, gold tends to stay understood and trusted.

Here’s how gold proves its long-term value:

- Gold has survived economic cycles: it has remained valuable through inflation, recessions, and market changes.

- It does not expire or become outdated: gold does not rely on technology, trends, or innovation cycles.

- Its value is recognized globally: gold means the same thing across countries and cultures.

- It protects long-term savings: over time, gold has helped preserve purchasing power better than cash.

- It rewards patience: Gold works best when held calmly, not rushed or traded emotionally.

Long-term value is often one of the strongest arguments. Gold may not move quickly, but its ability to remain relevant and trusted over decades is what makes it a reliable store of wealth rather than a short-term opportunity.

7. Global Demand for Gold Continues to Grow

Gold demand does not come from one place or one reason. It grows because many parts of the world rely on it for different purposes. Jewelry, investment, technology, and reserves all contribute to steady demand. This wide usage helps gold remain relevant even when markets and trends change.

When people look into 10 reasons to invest in gold, global demand often explains why gold does not lose its importance over time. As populations grow and economies expand, the need for gold increases. Emerging markets, in particular, continue to see gold as a trusted way to store and display value.

This ongoing demand matters to investors because it supports long-term stability. Gold is not dependent on one industry or one region. Its value is reinforced by global acceptance and continuous use. That broad demand base helps gold stay resilient, even when certain markets slow down or shift direction.

8. Central Banks Are Increasing Their Gold Reserves

Central banks usually move quietly, but their actions matter. When they change what they hold, it often reflects how they see the future of money and stability. In recent years, many central banks have increased their gold reserves as part of long-term planning.

Here’s why central banks continue to buy gold:

- They reduce reliance on single currencies: Gold helps balance exposure to major currencies like the dollar or euro.

- It strengthens national reserves: Gold adds stability to reserves during economic or political uncertainty.

- It protects against inflation and debt risks: Gold is not affected by interest rates or government borrowing.

- It offers long-term security: Central banks think in decades, not quarters.

- It is globally accepted: Gold can be used or traded anywhere without restrictions.

- It holds value during crises: History shows gold often gains importance when confidence in financial systems weakens.

central bank behavior is often overlooked. Yet these institutions manage massive reserves and long-term risk. Their continued shift toward gold sends a clear signal: gold still plays a serious role in protecting value when trust in currencies and systems is tested.

9. Gold Is Highly Liquid and Widely Accepted Worldwide

Liquidity matters more than many people realize. An asset only feels valuable if you can actually use it when needed. Gold has maintained its position because it can be bought or sold easily in almost any market, without complicated conditions or long waiting periods.

When investors talk about invest in gold, liquidity is often a quiet but important factor. Gold is recognized across countries, cultures, and financial systems. Whether in times of calm or crisis, there is usually a clear market willing to trade gold at transparent prices.

This global acceptance gives investors confidence. Gold does not depend on one exchange or one region to hold value. Its ability to move smoothly between markets makes it practical, not just symbolic. For people who value flexibility and access, this wide acceptance is one of gold’s most dependable strengths.

10. Gold Investment Is Accessible for Beginners and Professionals

Gold is often seen as a serious asset, but that does not mean it is difficult to access. One of gold’s strengths is how easily different types of investors can enter the market, regardless of experience level or budget.

Here’s why gold works for both beginners and professionals:

- It offers flexible entry points: you can start small or build larger positions over time.

- Physical options feel familiar: Gold bars and gold ornaments are easy to understand and own.

- Pricing is transparent: Gold prices are widely available and easy to follow.

- No complex knowledge is required: You do not need advanced financial skills to begin.

- It suits long-term and short-term goals: Gold can be held calmly or used strategically.

- Markets are well established: gold trades globally with clear standards and purity levels.

- Professional investors use it too: institutions and experienced investors rely on gold for stability and balance.

When people review 10 reasons to invest in gold, accessibility often stands out. Gold does not demand perfect timing or deep technical knowledge. It allows people to start at their own pace, grow with confidence, and remain connected to an asset that has worked across generations.

Bonus: Industrial and Technological Applications Increasing Gold’s Importance

Gold is no longer important only because people invest in it or wear it. Its role has expanded into technology, healthcare, and modern industries, giving gold practical value that goes far beyond tradition or long-term storage.

Gold in Electronics and Technology

Gold is widely used in electronics because it conducts electricity efficiently and does not corrode. This makes it essential in smartphones, computers, and communication devices that rely on stable performance over time.

Gold in Medical Applications

In medicine, gold is used in diagnostics, treatments, and specialized equipment. Its stability and compatibility with the human body give it value in areas where reliability is critical.

Growing Demand From Clean Technology

Gold is increasingly used in renewable energy and clean technology applications. As these sectors grow, gold demand grows with them in practical, measurable ways.

Limited Supply Meets Expanding Use

While industrial use continues to increase, gold supply remains limited. This balance supports gold’s long-term importance beyond traditional investment demand.

Beyond Jewelry and Investment

Gold’s role today extends far beyond jewelry and savings. Its presence in modern industries adds a layer of real-world demand that strengthens its position.

These industrial and technological uses show that gold’s value is not based on history alone. Its growing role in everyday technology helps reinforce why gold continues to matter in a changing world.

Risks to Consider Before Investing in Gold (and How to Manage Them)

| Area of Use | How Gold Is Used | Why It Matters |

| Electronics & Technology | Used in smartphones, computers, and communication devices because it conducts electricity efficiently and resists corrosion. | Ensures stable performance and long device lifespan, keeping demand consistent. |

| Medical Applications | Applied in diagnostics, treatments, and specialized medical equipment due to its stability and compatibility with the human body. | Supports critical healthcare uses where reliability is essential. |

| Clean & Renewable Technology | Used in renewable energy systems and modern clean-tech applications. | Growth in green industries increases practical demand for gold. |

| Limited Supply | Gold supply grows slowly while industrial usage continues to expand. | Supports long-term value through supply-demand balance. |

| Beyond Jewelry | Gold is no longer limited to jewelry or traditional investment roles. | Adds real-world utility that strengthens overall importance. |

Industrial and technological uses add practical demand to gold’s traditional value, reinforcing its relevance beyond investment and decoration alone.

How to Start Investing in Gold (Beginner-Friendly Steps)

Most people don’t start investing in gold with confidence. They start with curiosity, then questions, then a bit of hesitation. That’s normal. Gold feels simple, but taking the first step still needs clarity and patience. Here’s how beginners usually start investing in gold:

Start by defining your reason:

Some people want long-term value, others want stability or protection. Knowing why you’re buying matters more than how much you buy.

Choose the form of gold that feels right:

Physical gold, like bars or ornaments, feels more reassuring for many beginners because it’s tangible and easy to understand.

Begin with a small amount:

There’s no need to rush. One simple purchase helps you understand pricing, purity, and the process without pressure.

Focus on understanding prices, not timing:

At the beginning, learning how gold prices move is more useful than trying to buy at the perfect moment.

Keep records and stay organized:

Receipts, purity details, and dates matter more than many people expect over time.

When people explore 10 reasons to invest in gold, accessibility often stands out. Starting small, staying calm, and learning step by step is usually what turns gold from an idea into a comfortable long-term choice.

Why Choose Delor Gold for Your Gold Investment Journey

Choosing where to buy gold often matters as much as choosing gold itself. People want clarity, not pressure, and guidance that feels straightforward. Delor Gold focuses on keeping the process simple, especially for those who prefer understanding every step before making a decision.

When people explore reasons to invest in gold, trust and transparency usually come up early. Delor Gold offers clear pricing, well-defined product details, and physical options like gold bars and gold ornaments. This helps investors feel confident about what they are buying and why.

Another reason people choose Delor Gold is the calm experience it offers. There is no rush, no exaggerated promises, and no unnecessary complexity. With access through delor , investors can take their time, ask questions, and move forward at their own pace, which often makes the entire gold investment journey feel more comfortable and reliable.

Conclusion

Gold has never been about rushing decisions or chasing trends. It has always been about stability, patience, and long-term thinking. When you look at the 10 reasons to invest in gold, you start to see why it continues to matter across generations and changing markets. The key is choosing the right time, the right form, and a trusted source. Platforms like delor make this process clearer by offering physical gold options with transparency and simplicity, helping investors move forward with confidence rather than pressure.

FAQs

What is the return of gold in 5 years?

Gold returns over five years depend on timing and market conditions. It usually doesn’t move in a straight line, but many people find it helps preserve value rather than deliver fast gains.

Why is gold better than cash?

Cash slowly loses value over time because of inflation. Gold, on the other hand, tends to hold purchasing power better, especially over longer periods.

Will gold prices go up in 2026?

No one can predict prices with certainty. Gold prices respond to global events, inflation, and demand. Many investors focus less on exact years and more on long-term trends.

Is gold really a good investment?

Gold works well for people who value stability and patience. It is not about quick profits but about balance and protection within a broader financial plan.