Most people don’t start by thinking about companies. They start by thinking about gold itself. Then the question becomes who you’re actually buying from. A gold trading company can make things simple or confusing, depending on how it works. That’s why people end up searching for the Best gold trading company, not because they want the cheapest option, but because they want fewer doubts. A site like Delor feels easier for many buyers since you can see gold bars and gold ornaments clearly, without needing to ask too many questions. Trust usually starts there.

What Is a Gold Trading Company?

A gold trading company is simply the link between people and actual gold. It’s the place where buying, selling, or holding gold becomes possible without dealing directly with mines or large institutions. For most buyers, this company marks the beginning or end of their trust.

In practical terms, a gold trading company handles sourcing, verification, pricing, and documentation. Some focus on physical products, others work digitally, and some do both. The company’s size doesn’t matter; what matters is how clearly it explains the product and its price.

Many people don’t realize how important this role is until something goes wrong. A good company removes confusion before it starts. A bad one leaves buyers questioning purity, value, or even ownership. That difference shapes the entire experience.

Why Choosing the Right Gold Trading Company Matters

Most people don’t realize how important this choice is until after their first experience. That’s usually when the difference becomes obvious.

The right gold trading company doesn’t just sell gold, it removes doubt. You don’t spend time wondering if the price is fair or if the product is real.

- Peace of Mind: Long-term buyers often say the same thing: peace of mind matters more than small price differences.

- Reduced Risk: Choosing carefully at the beginning saves time, stress, and regret later on.

- Clarity: A good company explains things before you need to ask, rather than only after something goes wrong.

This choice affects every decision that comes after. When trust is missing, even good prices don’t feel right.

Learning the basics is essential, but achieving safe gold trading in UAE requires understanding the legal framework, market practices, and risk controls explained in the main guide.

Key Factors That Define a Trusted Gold Trading Company

People often think trust comes from reputation alone, but it usually doesn’t. It comes from small moments during the process, things you only notice when you slow down.

A trusted gold trading company doesn’t avoid uncomfortable topics. Pricing, purity, resale, paperwork — these things are explained before you even ask.

Key factors that build lasting trust:

- Transparency in Documentation: Documents are shared without hesitation. The essential paperwork for physical gold includes the Official Invoice, the Purity Certificate (Assay), and a clear transaction record.

- Consistency: Details don’t change from one conversation to the next. Consistency shows operational maturity.

- Handling of Questions: Are answers clear, or do they feel rushed and vague? Clarity stays in your head.

- Lack of Pressure: When someone pushes you to “decide now,” trust usually drops instantly.

- Time in Business: Companies that have been around longer tend to move more carefully and have processes tested by market changes.

- Post-Purchase Support: Follow-up matters more than marketing. Trust is real when the process feels quiet and stable instead of stressful.

Common Red Flags When Choosing a Gold Trading Company

Most red flags don’t look dramatic at first. They show up quietly, and people usually ignore them because they don’t want to overthink things. Ignoring these signs usually leads to regret later. Paying attention early saves stress, time, and money.

1. Vague Answers That Avoid the Main Point

One of the earliest signs is when answers feel unclear. You ask a simple question and get a long response that somehow avoids the point entirely. A trustworthy company provides direct, concise information.

2. Constantly Changing Details and Prices

A gold trading company that keeps changing details is a major warning sign. Prices might shift without explanation, or terms and conditions sound different every time you ask. Consistency is crucial in financial markets.

3. High-Pressure Tactics (Act Now)

Pressure is a big signal that something is wrong. Being told repeatedly to “act now” or “decide today” usually comes from a bad place, trying to rush you before you have time to think or research.

4. Lack of Essential Documentation

Lack of documentation should never be taken lightly. If certificates of authenticity, transaction records, or compliance documents are delayed or treated casually, that’s an immediate problem.

5. Relying on Promises Instead of Facts

Some companies rely heavily on empty promises instead of presenting solid facts or verifiable history. They talk a lot about potential gains but show very little concrete proof or clear procedures.

6. Defensiveness When You Express Doubt

Another critical red flag is how they handle hesitation. A trustworthy company stays calm and professional when you hesitate or ask tough questions. A risky one will often get defensive or aggressive.

7. Post-Payment Silence and Slow Replies

People also notice what happens immediately after payment is made. Sudden silence, exceptionally slow replies, or an immediate change in the company’s tone often say more than their initial sales pitch.

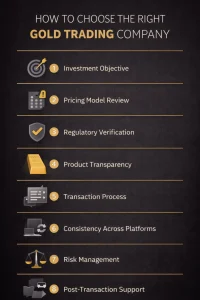

Step-by-Step Guide to Choosing the Right Gold Trading Company

1. Define Your Core Investment Objective

The first step is defining your objective clearly. Are you buying gold for long-term investment, portfolio diversification, or short-term trading? This fundamental decision determines the specific type of gold trading company, products, and services you should be working with.

2. Scrutinize the Operational and Pricing Model

Review the company’s operational model thoroughly. A professional entity should clearly explain how pricing is calculated, how market spreads are applied, and how market movements affect your final costs. Transparency here is non-negotiable.

3. Critical Regulatory Verification and Compliance (Must-Haves)

Verification is the most critical step. You must confirm that the company operates under recognized regulatory frameworks and complies with industry standards.

- Regulatory Status: Always confirm that the company operates under recognized regulatory frameworks, especially those overseen by local bodies (e.g., DMCC or relevant Economic Departments).

- Essential Documents: Insist on receiving and verifying the following documents: Official Invoice, Assay Certificate (Purity), and Clear Transaction Records.

4. Ensure Product Transparency and Certification

Product transparency comes next. A reliable provider must clearly specify the gold’s purity levels (e.g., $99.99\%$), weight accuracy, and the specific certification methods used without any ambiguity.

5. Evaluate the Transaction and Audit Process

Assess the transaction processes. A structured, secure purchase flow, clear invoicing, and easily traceable records indicate high operational maturity and reliability.

6. Demand Consistency Across All Platforms

A credible gold trading company should provide unwavering consistency across all communication channels, pricing platforms, and documentation without any discrepancies. Inconsistent details are a major warning sign.

7. Understand Risk Management Policies

Risk management policies matter. Before committing, clearly understand how the company handles market volatility, what their delivery timelines are, and the process for effective dispute resolution.

8. Assess Post-Transaction Support

Evaluate the post-transaction support provided. The ability to resell, verify the authenticity of the gold later, or obtain ongoing assistance after the purchase is a key indicator of the company’s long-term reliability and professionalism.

9. Comparative Final Assessment

Finally, compare multiple providers objectively using the same strict criteria mentioned above. Decisions based on regulatory structure, compliance, and clarity tend to outperform those based solely on the lowest price.

Why Many Investors Prefer Established and Reputable Companies

Investors consistently prefer established companies because years of experience reduce uncertainty in sensitive gold transactions. Long-standing operations are characterized by clearer processes and minimal improvisation.

Core Reasons for Choosing Reputable Providers:

1. Absolute Pricing Transparency

Reputable companies clearly explain how their prices are formed, how spreads are applied, and how market movements affect the final cost.

2. Documentation and Record Consistency

Established companies are far more likely to provide consistent certificates, official invoices, and traceable records without delay, which is crucial for due diligence.

3. Product Purity and Consistency

Investors expect and receive consistent purity standards (e.g., $99.99\%$ for investment bars) and accurate weight measurements every single time they purchase.

4. Operational Stability and Market Resilience

Companies that have successfully navigated various market cycles usually handle volatility, logistics, and supply chain challenges more effectively.

5. Clear Resale and Liquidity Planning

Resale options are often clearer and more structured with reputable providers, which is essential for investors planning for future liquidity.

Added Value and Trust Indicators:

- Data-Driven Trust: Over time, trust becomes data-driven rather than emotional, built on smooth, repeated outcomes instead of mere promises.

- Predictability and Process: Clear delivery timelines and structured transaction steps reduce unnecessary risk and provide predictability.

- Post-Transaction Support: Established companies respond consistently and professionally, both before and after the transaction.

- Simplified Verification: Trusted providers simplify purity checks and authentication processes for physical gold buyers.

This overall reliability allows investors to focus on their strategic goals instead of worrying about operational concerns.

How Delor Gold Meets the Standards of a Trusted Gold Trading Company

Before looking at details, it helps to pause and understand what actually makes one company feel different from another. The points below focus on practical things buyers usually notice only after dealing with gold more than once.

Clear Product Information from the Start

- One of the main strengths is clarity. Product details are presented in a direct way, without overcomplication.

- Buyers can see weight, purity, and form clearly, whether they are looking at gold bars or gold ornaments.

- This removes the need for follow-up questions and reduces decision time.

Structured and Transparent Pricing

- Pricing follows a clear logic tied to market movement rather than vague estimates.

- Costs are visible upfront, which helps buyers understand exactly what they are paying for.

- This level of transparency is essential when dealing with high-value assets.

Verified Quality and Documentation

- Every product comes with proper documentation that supports authenticity and purity.

- Verification is treated as part of the process, not an optional step.

- This is especially important for investors who plan to hold or resell later.

Consistent Buying Experience

- The purchasing flow feels stable and predictable from start to finish.

- Communication stays consistent, and information does not change mid-process.

- That consistency is a key reason many buyers return.

Long-Term Reliability Over Short-Term Sales

- Delor operates with a long-term mindset, focusing on repeat trust rather than one-time transactions.

- This approach reflects how a professional gold trading company should operate in a regulated and investment-focused market.

Final Tips for Choosing the Best Gold Trading Partner

- Define your objective clearly: Are you purchasing gold for investment holding, resale, or portfolio diversification?

- Evaluate operational transparency: A professional partner explains pricing structure, spreads, and market linkage without ambiguity.

- Confirm product specifications: Weight accuracy, purity level, and certification should be clearly stated and verifiable.

- Review documentation flow: Invoices, certificates, and transaction records should be issued automatically.

- Assess consistency across channels: Pricing, terms, and product details should remain the same whether communicated online or directly.

- Examine delivery and fulfillment terms: Clear timelines and responsibility allocation reduce post-transaction disputes.

- Avoid decisions based solely on promotional offers: Structural reliability often matters more than marginal price differences.

Conclusion

Gold decisions are rarely about speed. They are about clarity. People usually take time before trusting anyone with something valuable. A gold trading company is judged less by promises and more by how simple the process feels from start to finish. When information is clear and steps are predictable, decisions become easier. Platforms like Delor work for many buyers because nothing feels hidden or rushed. Gold bars and ornaments are shown as they are, with details that make sense. Ultimately, the optimal option is typically the one that resolves all uncertainties and alleviates any pressure following the transaction.

FAQs

How do I verify if a gold trading company is legitimate?

Typically, one can verify the legitimacy of a gold trading company by scrutinizing their licenses, documentation, and the transparency of their product details. Legitimate companies don’t hesitate when asked about purity, certificates, or transaction records.

What purity of gold is best for investment?

Most investors prefer higher purity levels because they are easier to verify and resell later. Purity matters more for investment than for decorative use.

Can beginners start with small amounts?

Yes, and many people do. Starting small helps you understand pricing, process, and timing without unnecessary pressure.

Is physical or digital gold better?

It depends on comfort levels. Physical gold feels more tangible and easier to understand, while digital gold offers convenience and flexibility.

Why does the choice of company matter so much?

This is due to the company’s control over pricing clarity, documentation, and post-purchase support. These factors affect the entire experience more than people expect.

Do established companies offer better security?

In most cases, yes. Experience usually comes with stronger processes and clearer standards.